New payroll tax will impact residential, assisted living and home care providers in B.C.

Announced as a part of Budget 2018, the new Employer Health Tax (EHT) announced by the B.C. government will have significant financial implications for the continuing care sector. Non-government providers in the continuing care sector had an accessible payroll of over $1.9 billion dollars as of 2015, suggesting that the new employer health tax will net approximately $38 million in taxes annually. While the net effect of the tax will vary from operator to operator, many continuing care providers will have their costs increase significantly and abruptly. Care providers will also face additional costs due to tax duplication in the 2019 transition year.

How the Employer Health Tax will work

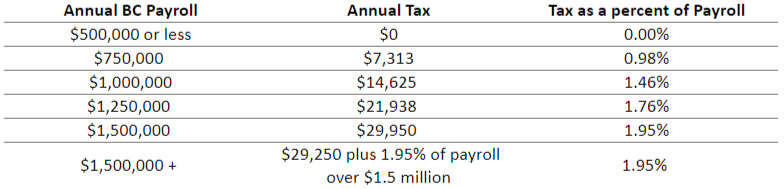

The EHT will be a tax imposed on employers based on the size of their payroll. Small businesses with an annual BC payroll of $500,000 or less will be exempt from this levy. The tax rate will start at 0.98 percent for annual payrolls in excess of $500,000 and will gradually increase to 1.95 percent for B.C. payrolls in excess of $1,500,000 per year. The chart below shows the proposed tax rates for defined payroll ranges.

The Employer Health Tax will become effective January 1, 2019. However, MSP will not be phased out until January 1, 2020. This means that for one year, employers will be taxed twice for their workers health coverage.

Effect on Continuing Care Providers in B.C.

Many operators in the continuing care sector will be negatively affected by the new Employer Health Tax. Staffing expenses in the continuing care sector typically account for between 75-80% of operating revenue; thus, even a 2% tax on annual payroll has significant implications for the organization’s financial viability.

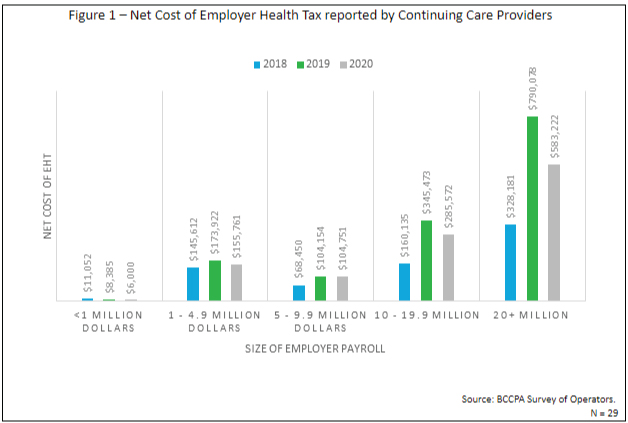

Operators that have higher salaried employees, as well as those with a significant number of casual workers will face the most significant increases in costs. Furthermore, operators will also face tax duplications during the 2019 transition year (see Figure 1 below).

As a result of these changes, many operators report that they will be forced to change their operations in order to cover these additional costs. Operators cite changes such as reducing staffing, raising prices for residents/clients, and renegotiating benefit packages with unions.

For more information about the survey, download a full copy of the report here.

BCCPA has approached the B.C. government to express our members’ concerns over the impact of the new payroll tax, and will be seeking an exemption for publicly-funded continuing care providers, or additional funding to cover these costs.